Finance

Our finance team will prepare a full projected Profit & Loss Account and a projected cash flow for your specific site (encompassing specific rents etc.) once a location has been selected.

These figures together with our research summary for the location will then be used to present your business proposition to one of the major clearing banks; a number of which have experience of Snappy Snaps stores on which to base their risk decision.

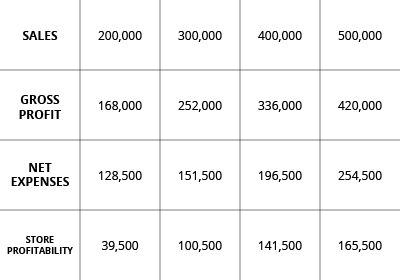

Based on the average returns in the group and our experience, the expected returns for an average Snappy Snaps store could be as follows:

We would expect our new stores to be able to achieve minimum net sales of £200,000 per annum within a reasonable period.

This will obviously be dependent on the site and the local trading environment.

*The net expenses figure includes all expenses associated with operating a Snappy Snaps store including labour, rent and rates, other expenses, the 6% on-going franchisee fee and the 2% marketing contribution.

Store profitability is sometimes known as EBITDA (earnings before interest, depreciation and amortization).

NB These figures represent estimates only and future projections can never be guarantees of actual performance.

The initial VAT (which is fully recoverable) can be financed by short-term overdraft if required. These figures provide you with a guide as to the start-up costs for a Snappy Snaps store.

There will be some variances with the above depending upon the location and size of your Snappy Snaps store and the point during the year that completion takes place.

| Site Acquisition including legal fees | 15,000 |

| Shop fitting complete | 50,000 |

| Initial stock | 15,000 |

| Equipment | 60,000 |

| Initial Franchisee Fee | 17,500 |

| Opening Promotional Launch | 4,000 |

| Your personal Legal Fees | 5,000 |

| Living costs during training and opening | 3,500 |

| Working Capital(upto) | 20,000 |

| FUNDING REQUIRED | 190,000 |

| Your input (minimum) cash in hand | 48,000 |

| Bank Loan | 82,000 |

| Machine finance | 60,000 |

| TOTAL FUNDING | £190,000 |